Table of contents

Definition

The tax-to-GDP ratio is a metric that measures the size of a country's tax revenue in comparison to its Gross Domestic Product (GDP).

- It is expressed as a percentage.

- The tax-to-GDP ratio measures the size of a country's tax revenue compared to its GDP.

What does the ratio indicate?

- The higher the tax-to-GDP ratio, the better the country's financial position.

- A greater tax-to-GDP ratio indicates that the government can cast a wider fiscal net.

- It helps a government become less reliant on borrowing.

Essentially, it tells us how much of the country’s overall economic output is collected in the form of taxes.

For example, if a country has a GDP of $100 billion and collects taxes worth $10 billion, the tax-to-GDP ratio would be 10%. This ratio is an indicator of the tax burden on an economy and reflects the government's capacity to fund its operations through tax revenues.

A research paper by NACIN (National Academy of Customs, Indirect Taxes and Narcotics) observed that –

- Countries significantly increase the overall level of taxation (as a share of GDP) as they become richer.

- This is in line with Wagner‘s law, which states that the size of the government — proxied by the tax (and expenditure) share to GDP — rises as the associated country‘s income level also rises.

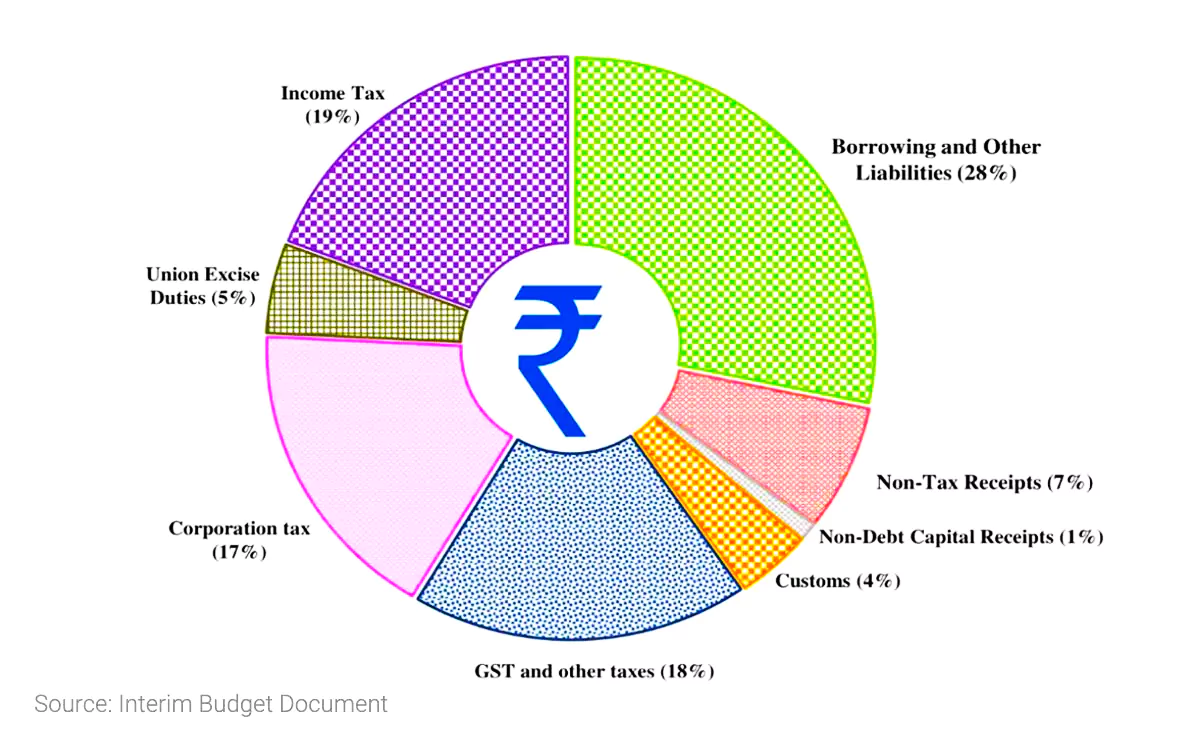

Government's Source of Income

We can't clear UPSC for you.

But with our personalised mentor support, you'll be ready to do it yourself.

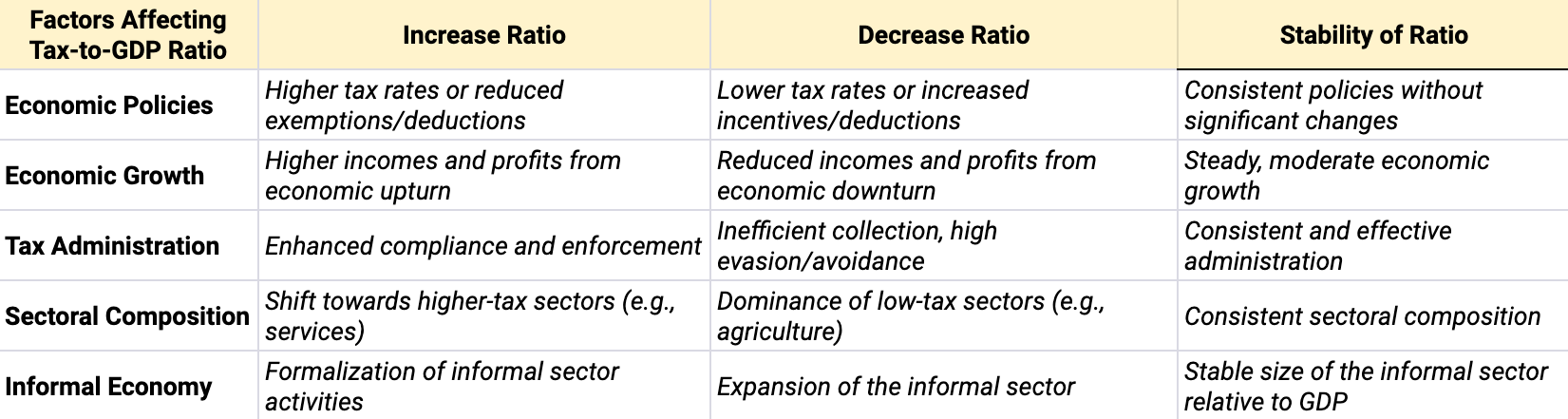

Factors that affect the tax-to-GDP ratio

- Economic Policies: Tax rates, exemptions, deductions, and incentives can influence the total tax collected.

- Economic Growth: Higher economic growth can lead to higher incomes and profits, potentially increasing tax revenue.

- Tax Administration: Efficiency in tax collection and combating tax evasion directly impact the ratio

- Sectoral Composition: Economies reliant on high-tax sectors, like services, may have higher ratios than those reliant on low-tax sectors, like agriculture.

- Informal Economy: Larger informal sectors often lead to lower tax collection since many transactions are not recorded or taxed.

Trends:

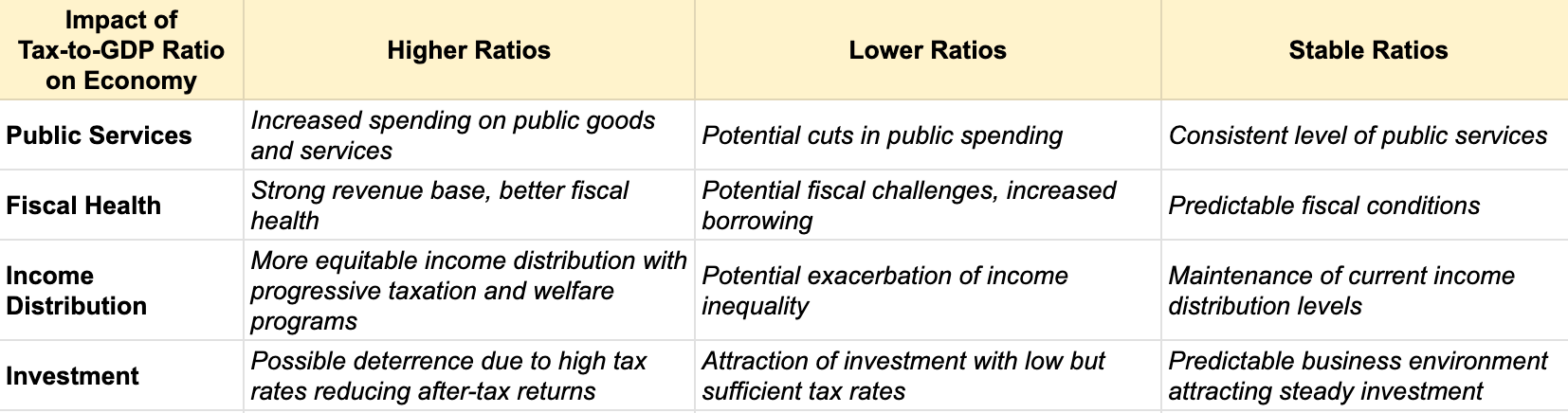

The tax-to-GDP ratio can affect various aspects of an economy:

- Public Services: Higher ratios may enable governments to invest more in public services and infrastructure.

- Fiscal Health: A healthy ratio suggests a government is more capable of funding its obligations without excessive borrowing.

- Income Distribution: Progressive tax systems, which can lead to a higher tax-to-GDP ratio, may contribute to more equitable income distribution if the tax revenue is used for social welfare programs.

- Investment: High tax-to-GDP ratios, if resulting from high tax rates, may discourage investment. Conversely, a moderate ratio with stable tax policies might attract investment.

Trends:

Understanding the tax-to-GDP ratio is crucial as it encompasses fiscal policy, economic health, and administrative efficiency, all of which are key areas in public administration and policy-making.