Table of contents

The world of finance can seem like a complex language, but understanding key capital market terms unlocks valuable insights.

This section demystifies important capital market terms making headlines, equipping you to navigate financial news with confidence.

Let's break down the jargon and unlock the secrets of the capital market!

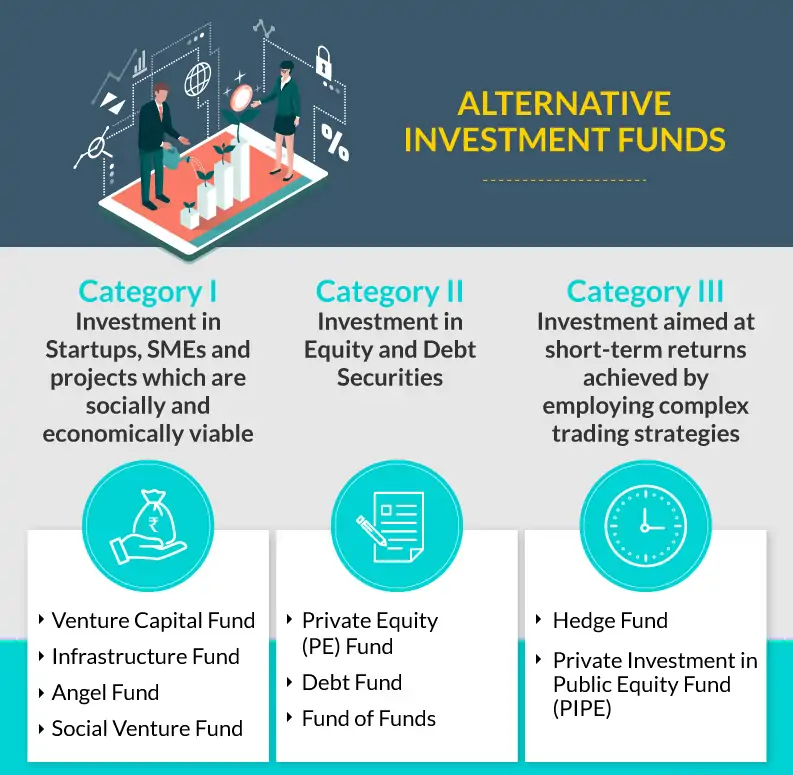

Alternative Investment Fund

- Alternative investment fund (AIF) is a privately pooled investment fund established in India that collects funds from both Indian or foreign investors.

- AIFs can be formed as a company, trust, Limited Liability Partnership etc.

- Funds from investors are pooled and invested under different categories as specified by the SEBI.

- Institutions and high net worth individuals invest in AIF due to the requirement of a high investment amount.

- There are three categories Of AIF-

- Category I AIFs can invest in start-ups, social ventures, SMEs, early stage ventures and sectors which the government consider as socially or economically desirable.

- Category II AIFs are not classified under Category I or Category III. They do not go for leverage or borrowing other than for meeting day-to-day operational requirements.

- Category III AIFs are funds which employ complex or diverse trading strategies and may employ leverage.

Bond Yield

- Bond is a loan floated by an investor for a borrower for a time period in return for interest payments.

- Time period from when the bond is issued to when the loan is paid back is called its ‘term to maturity’.

- Bond price and yield are inversely related.

- The issuer uses the money raised to undertake activities like refinancing existing debt, funding expansion projects, welfare activities, etc.

- Bond yield is the return expected by an investor, each year, over its term to maturity.

- The bondholders receive the bond’s at face value, at par value, at discount or at premium.

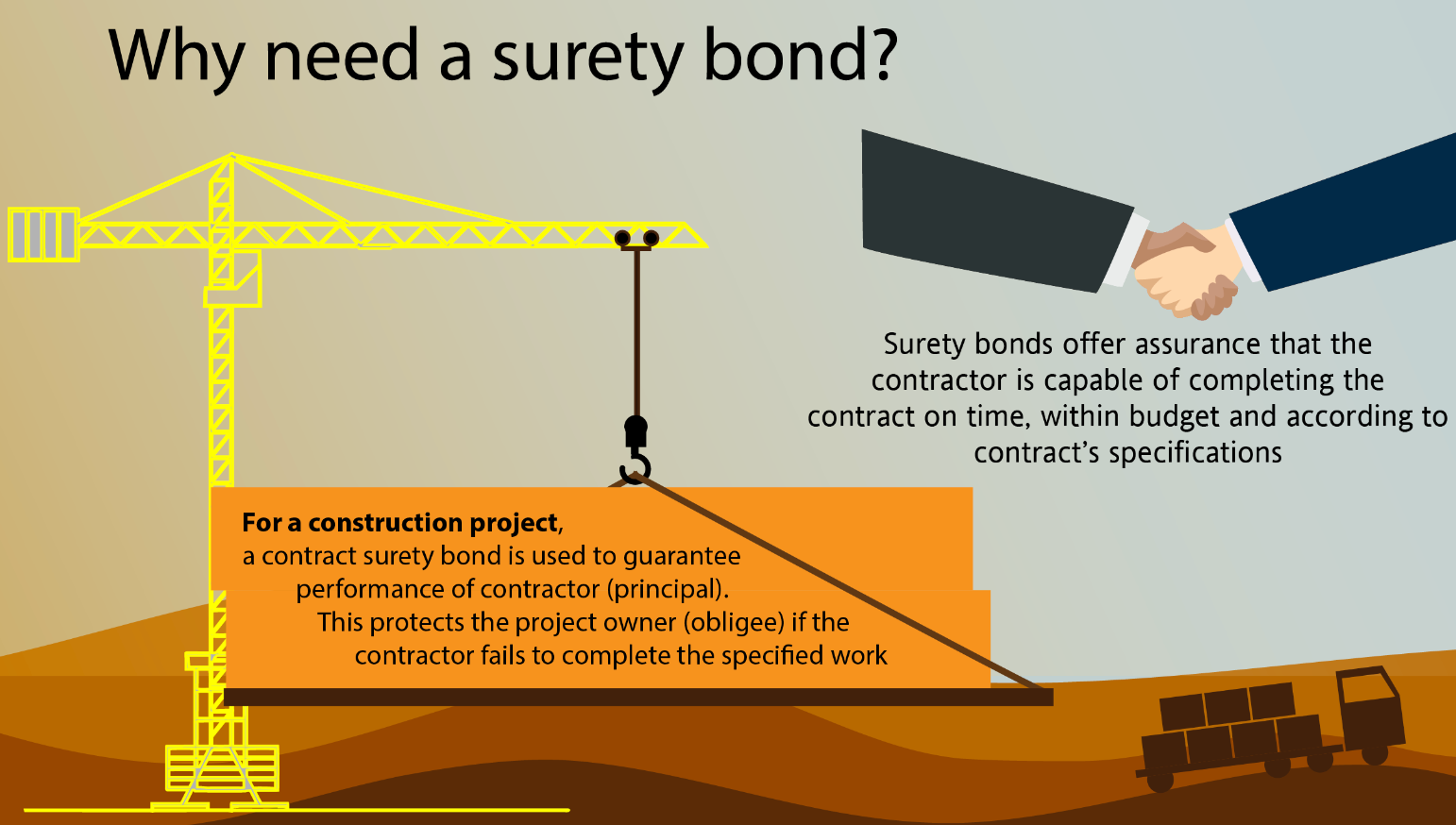

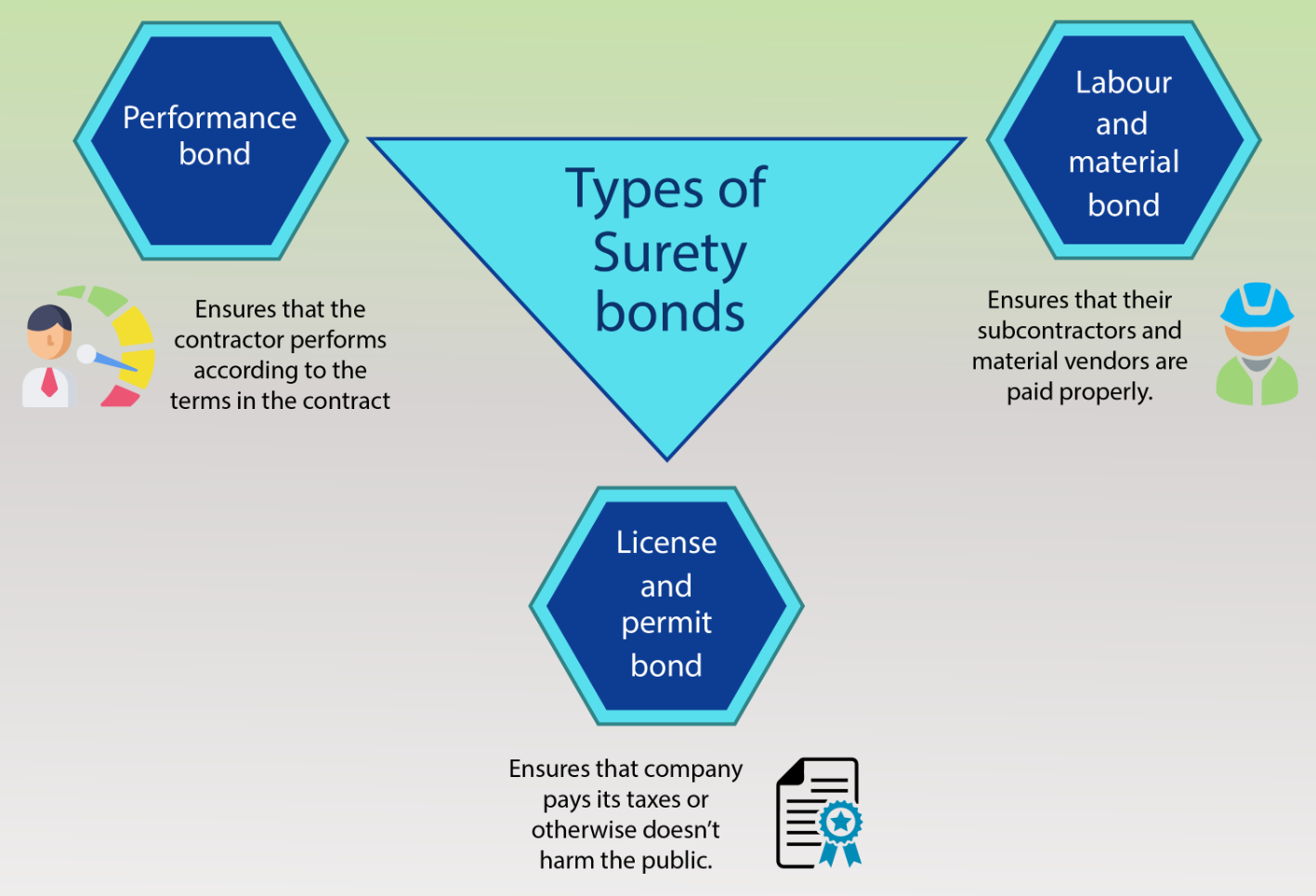

Surety Bonds

- Surety bonds are floated to transfer risk and an insurance company provides guarantee to a beneficiary.

- It is a legally binding three party contract which guarantees that the principal or contractor will fulfill their obligations.

- Role of the insurer is to compensate the obligee monetarily in case the principal fails to deliver.

- Insurance companies like SBI General are surety providers.

- Obligee or beneficiary is the government or infrastructure development authorities.

- Principal is the owner or contractor who purchases the surety bond from an insurer as a guarantee.

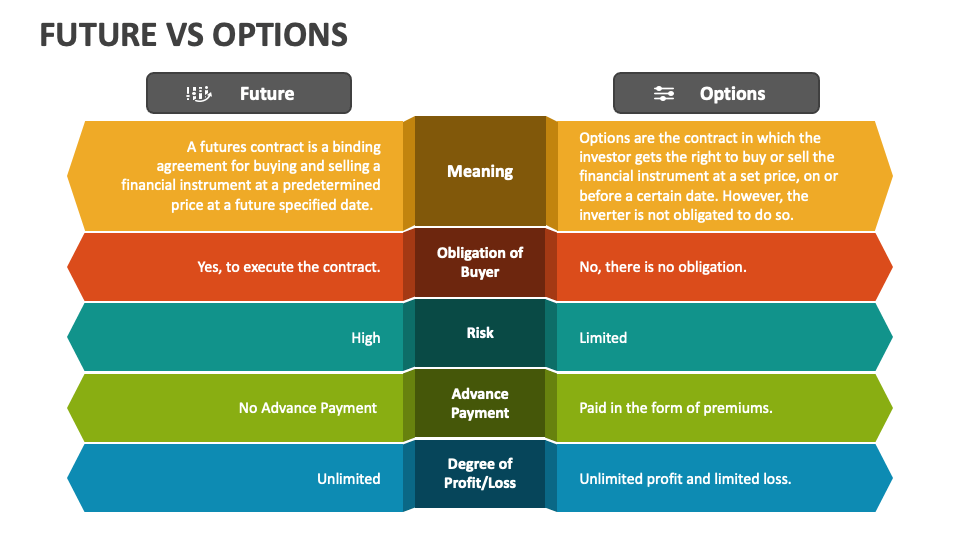

Future & Options

- Futures contract is an asset buying or selling agreement between a buyer and seller at a certain time and a certain price in the future.

- Purchase and selling must be done at the set price irrespective of the current market price.

- The underlying assets involved include physical commodities and financial instruments.

- They are highly susceptible to risk but can reap unlimited profit as well.

- Options contract is an instrument which gives an investor the right but not the obligation to buy or sell a commodity at a specified price and future date.

- The risk is limited but the profit or loss is unlimited.

Share Buy-Back

- Share Buyback or repurchase occurs when a listed company buys its own shares from the existing shareholders.

- Due to buyback, the number of outstanding shares in the open market are reduced over a period of time.

- Share buyback is done through a tender offer, from the open market, stock exchanges, or from odd-lot holders.

- The maximum cap on buyback is 25 per cent or less of the aggregate of paid-up capital and free reserves of a company.

- Companies go for buyback when they feel that its stock is undervalued or has fallen too much.

Market Capitalization

- Also called market cap, it represents the market value of a company based on its current share price and the total number of its outstanding shares.

- It shows the market’s perception of a company’s worth, its size and significance in the financial markets.

- Market cap is a basis on which companies are classified as large-cap, mid-cap, or small-cap companies.

- Large-cap companies are usually stable, well-established and reputable businesses with market caps of INR 20,000 crore or more.

- Mid-cap companies have a market cap ranging from INR 5,000 crore to INR 20,000 crore.

- Small-cap companies have a market cap of less than INR 5,000 crore.

Reverse-Flipping

- Reverse flipping involves internalizing and integrating the ownership and value of an entity back into the parent country.

- Simply said, it is a trend of overseas start-ups shifting their domicile to India and listing on Indian stock exchanges because these setups tend to capitalize on India’s large and growing economy, deeper pools of venture capital, young and educated population, better intellectual property protection and favorable government policies.

- It is driven by factors like increased certainty of an exit at a higher valuation in India.

- Companies such as PhonePe and Pepperfry have recently internalized in India.

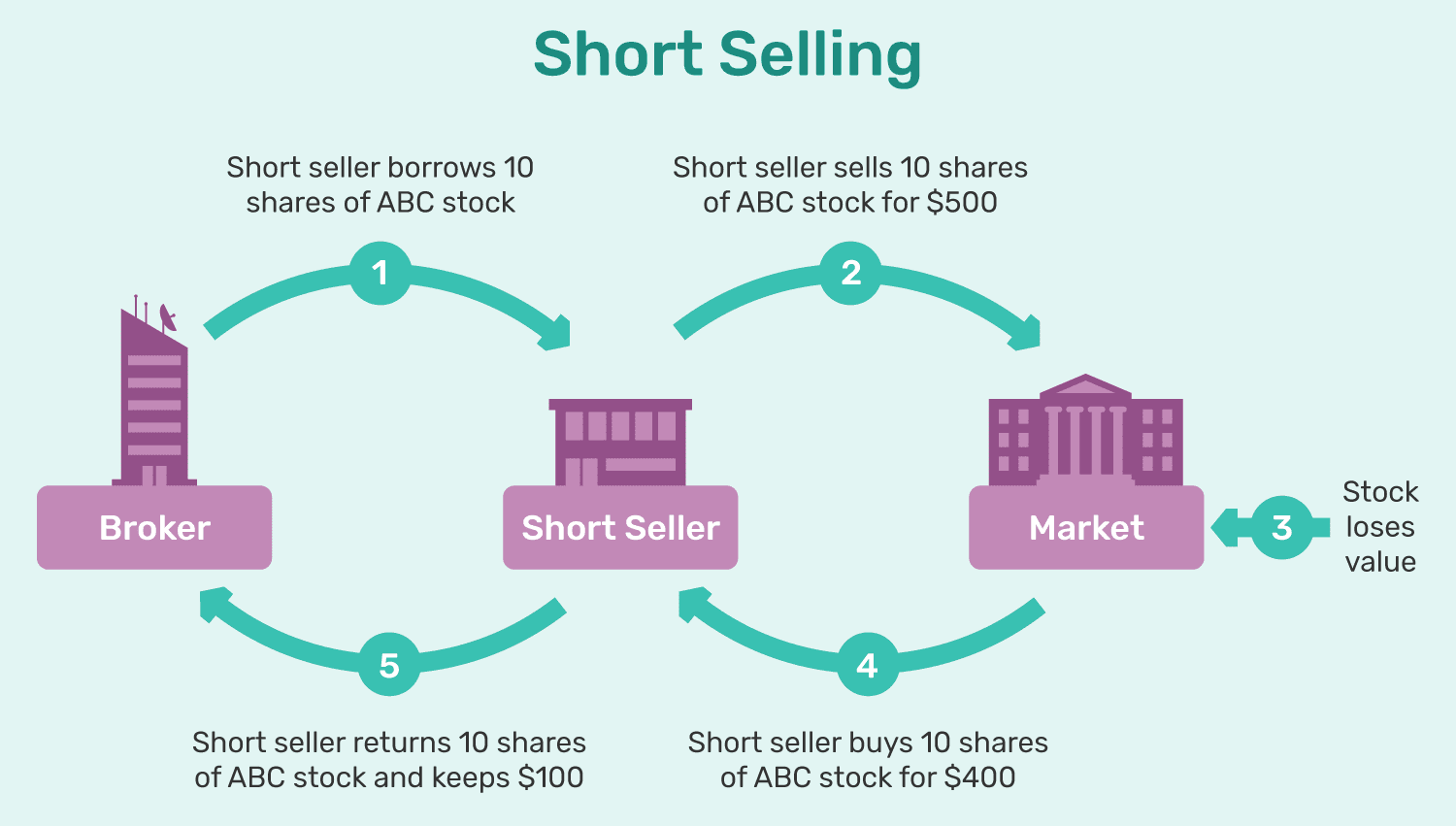

Short-Selling

- A trading strategy which is based on the expectation that the price of the security will fall in future.

- It is based on speculation of a decline in a stock or other security’s price.

- It involves an investor borrowing a security and selling it in the open market to buy it back later for less money.

- The betting and profit is based on a drop in a security’s price and has a high risk/reward ratio.